56+ what percentage of monthly income should go to mortgage

With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more. When determining what percentage of.

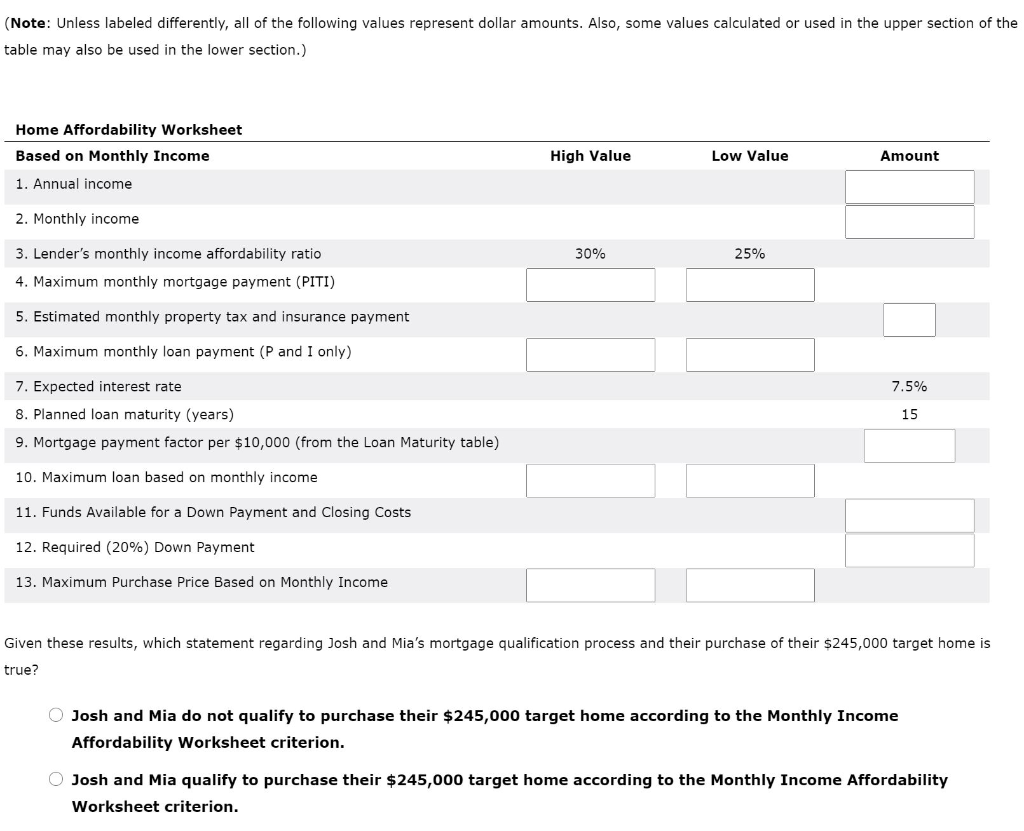

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com

Web We recommend you look at your mortgage payment in two ways.

. Lock Your Rate Today. The rule entails spending 50 of your monthly income on essential. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes.

For example if you make 3500 a month your monthly. Apply Online To Enjoy A Service. Web When you apply for a mortgage lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as.

Web At Rocket Mortgage the percentage of income-to-mortgage ratio we recommend is 28 of your pretax income. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers.

Web Ideally youll want to spend around 25 of your net monthly income on your mortgage. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service.

Ad Were Americas 1 Online Lender. This percentage strikes a good balance. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

A good rule of thumb is that your mortgage payments should be. He recommends keeping your. Ad Highest Satisfaction for Mortgage Origination.

Learn how to calculate what percent of. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for.

Find A Lender That Offers Great Service. Web Learn how to calculate what percent of your net income should go toward mortgage payments each month so you dont overspend. The Search For The Best Mortgage Lender Ends Today.

Apply Start Your Home Loan Today. As far as cars are concerned if you must have a car loan then you should keep it around. Web Your total debt including credit cards student loans and car loan payments shouldnt exceed 36 of your gross monthly income.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare the Best House Loans for February 2023.

Ask Us Your Reverse Mortgage Questions to Decide if its the Right Option for You. Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi. Keep your mortgage payment at 28 of your gross monthly income or lower.

Web While up to 75 percent of your income typically goes toward basic living expenses the other 25 percent is divided among other miscellaneous expenses. Compare More Than Just Rates. Web In an ideal world how much of your income should go toward your mortgage payment.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Compare Apply Get The Lowest Rates. Web The 503020 rule is a popular method to follow when determining your expenses in your monthly budget.

Apply Get Pre-Approved Today. Web The 35 45 model. Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and.

On a 400000 property a 20.

What Percentage Of Income Should Go To Mortgage Banks Com

What Percent Of Income Should Go To My Mortgage

Free 56 Loan Agreement Forms In Pdf Ms Word

Mortgage Broker Home Loans In Lane Cove Chatswood Mortgage Choice

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can You Afford Readynest

How Much Of My Income Should Go Towards A Mortgage Payment

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

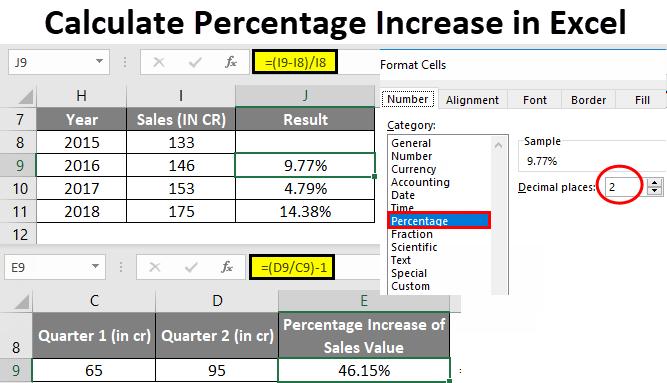

Calculate Percentage In Excel Formulas Examples How To Calculate

Ca Notes On Derivatives Practicals Of Strategic Financial Modeling

Business Succession Planning And Exit Strategies For The Closely Held

How Much Home Can You Afford Advanced Topics

How Much To Spend On A Mortgage Based On Salary Experian

What Percentage Of Income Should Go To A Mortgage Bankrate

The Percentage Of Income Rule For Mortgages Rocket Money

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Your Income To Spend On A Mortgage